Though the world has gone through a lot over the last 2 years because of Covid-19, we cannot assume that the threat of viruses is over. However, the pandemic taught us a lot, especially to all companies that interact with society. Taking into account this present situation, ESG (Environment, Society, & Corporate Governance) holds great significance for all as a global community. In the past, business communities, especially large corporations, placed value on profitability, shareholder wealth & stakeholder value, but the pandemic has thrown everything out of gear, forcing them to consider how their output would affect society, the environment, employees, and communities.

ESG metrics go beyond a company’s balance sheet and P&L. It clearly explains what assets one deploys and out it produces. It puts more emphasis on the purpose. Will it increase employee engagement or diversity? Will it improve the overall well-being of the community?

ESG –New direction

According to a recent study, 29% of companies have started to include ESG metrics in their overall planning and strategy. Covid-19 has pushed many big investment houses to focus on the purpose of the company when making investment decisions. Private equity firms want to know what their money will be used for & whether it will positively affect people & the environment. Will the profits solve the problems? The idea of stakeholder capitalism is going to wean away, more balanced capitalism is going to come to the fore. Even though there are changes visible in some of the big organizations, overnight changing everything is remote or impossible. However, some gradual changes in approach & thinking may finally be evident in the coming decade.

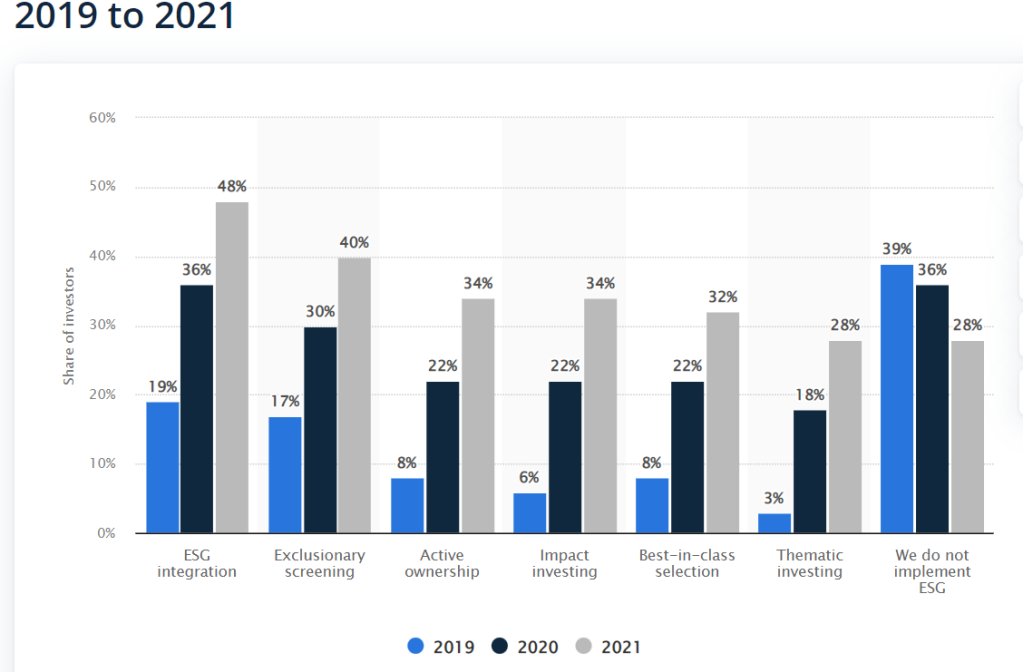

ESG Adoption Among Institutional Investors

Purpose meets the eye

The changes would result in some tradeoffs, but the long-term impact they would have on the planet would be enormous. According to McKinsey, they have developed a model called 5Ps named SCORE ( Simplify Connect Own Reward & Exemplify)

Simplify : Ensures the purpose is simple and convincing

Connect : Making the purpose connects with practice

Own : Board of the company owns the purpose without any dilution.

Reward : supporting & motivating the purposeful behaviour

Exemplify: Beautiful stories that narrate the purpose

Impact on the stock market:

As per the report companies on the NYSE & NASDAQ having better ESG records were performing better but collapsed during the pandemic now same stocks regained the momentum post-pandemic It shows that investors are showing more trust in the companies with Better ESG records in execution with a purpose.

- May 2023

- January 2023

- October 2022

- March 2022

- December 2021

- August 2020

- June 2020

- April 2020

- June 2019

- January 2019

- December 2018

- August 2018

- July 2018

- March 2018

- February 2018

- January 2018

- December 2017

- October 2017

- September 2017

- August 2017

- October 2016

- August 2016

- April 2016

- January 2016

- December 2015

- August 2015

- July 2015

- April 2015

- March 2015

- February 2015

Leave a comment